Table of Content

These costs increase with age, as seen with online quotes from Mutual of Omaha. A married 60-year-old female will pay $160 and $319 per month for $2,100 to $4,100 in monthly benefit amounts, which jumps to $249 and $497 for the same coverage amounts for a married 70-year-old female and $363 and $726 for a married 75-year-old female. Keep in mind that Medicaid and private insurance often do not cover the costs of long-term care or any of the LTC-related costs, making a specific LTC insurance policy a good idea if you think you may need coverage.

For the same policy, yearly premiums for policies purchased at the age of fifty are significantly less than premiums purchased at the age of seventy. In addition, the earlier you purchase your policy, the more likely you are to have your application approved. "The first and most important thing consumers need to know is if they are dealing with an agency that employs its own caregivers," says Leann Reynolds, President of Homewatch CareGivers, a home care company with over 170 locations worldwide.

Brighthouse Financial

This site is for information and support; it is not a substitute for professional advice. Your feedback is anonymous and will be sent directly to Philadelphia Insurance team to help improving our services. The American Association for Long-Term Care Insurance thanks Homewatch CareGivers and the National Private Duty Association for providing the following information on home care.

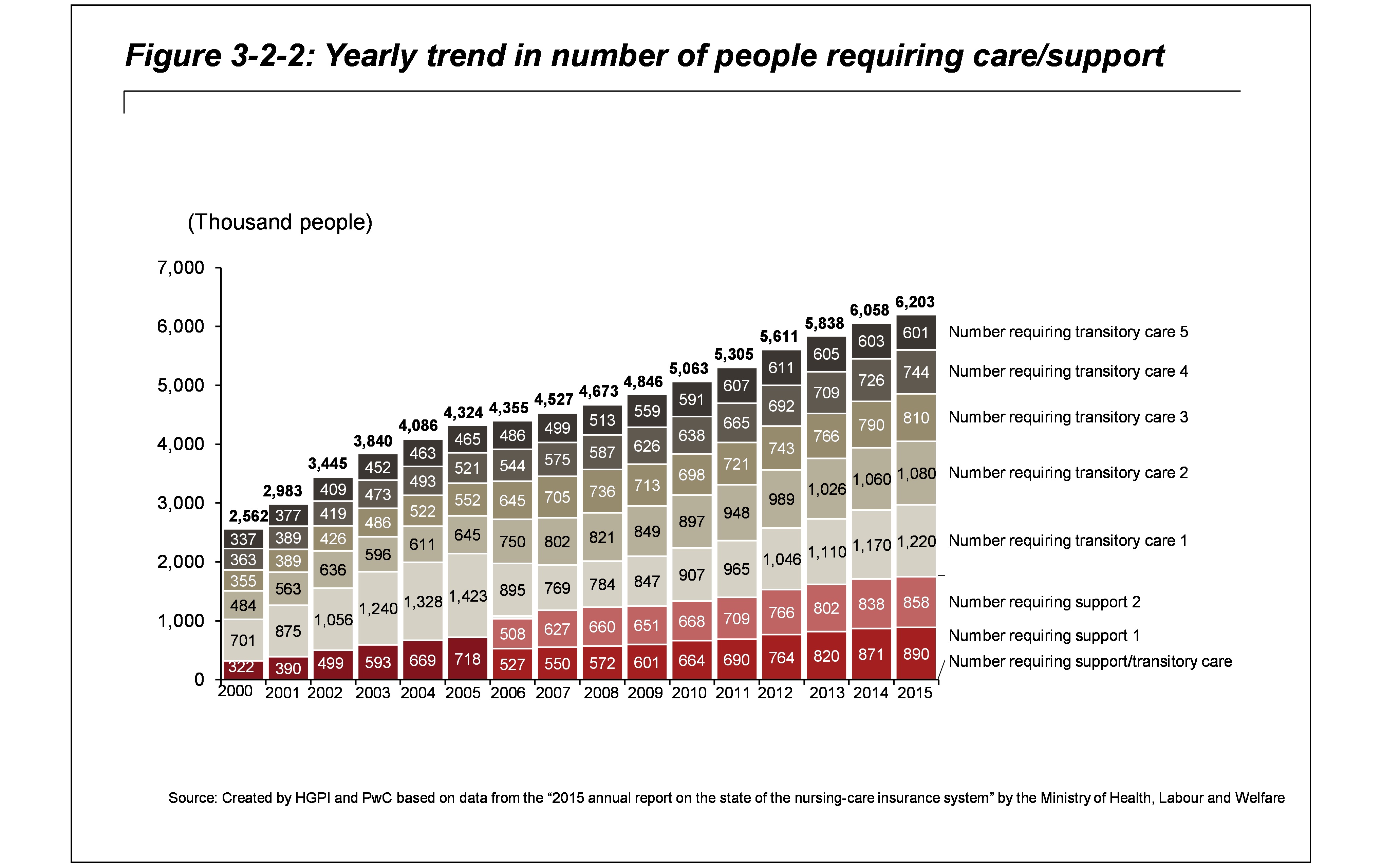

It is important to know that the cost of long-term care is expected to grow significantly over the next few decades. In the next thirty years, the annual cost of long-term care is expected to increase over 330% to over $300,000 a year for a home care aide and even more for a nursing home or assisted living facility. For most of us, that means that the care we need as we age will be more than we are able to save through investments or other private sources, making Long-term care insurance a smart investment in our future independence and safety. Most people buy long-term care insurance just so they can receive care in their own home. Click here to complete our simple online questionnaire and be connected with an expert in your area to find out whether you can health qualify for long-term care insurance and what coverage costs. If you have a Medicare Supplement Insurance policy or other health insurance coverage, tell your doctor or other health care provider so your bills get paid correctly.

Applications

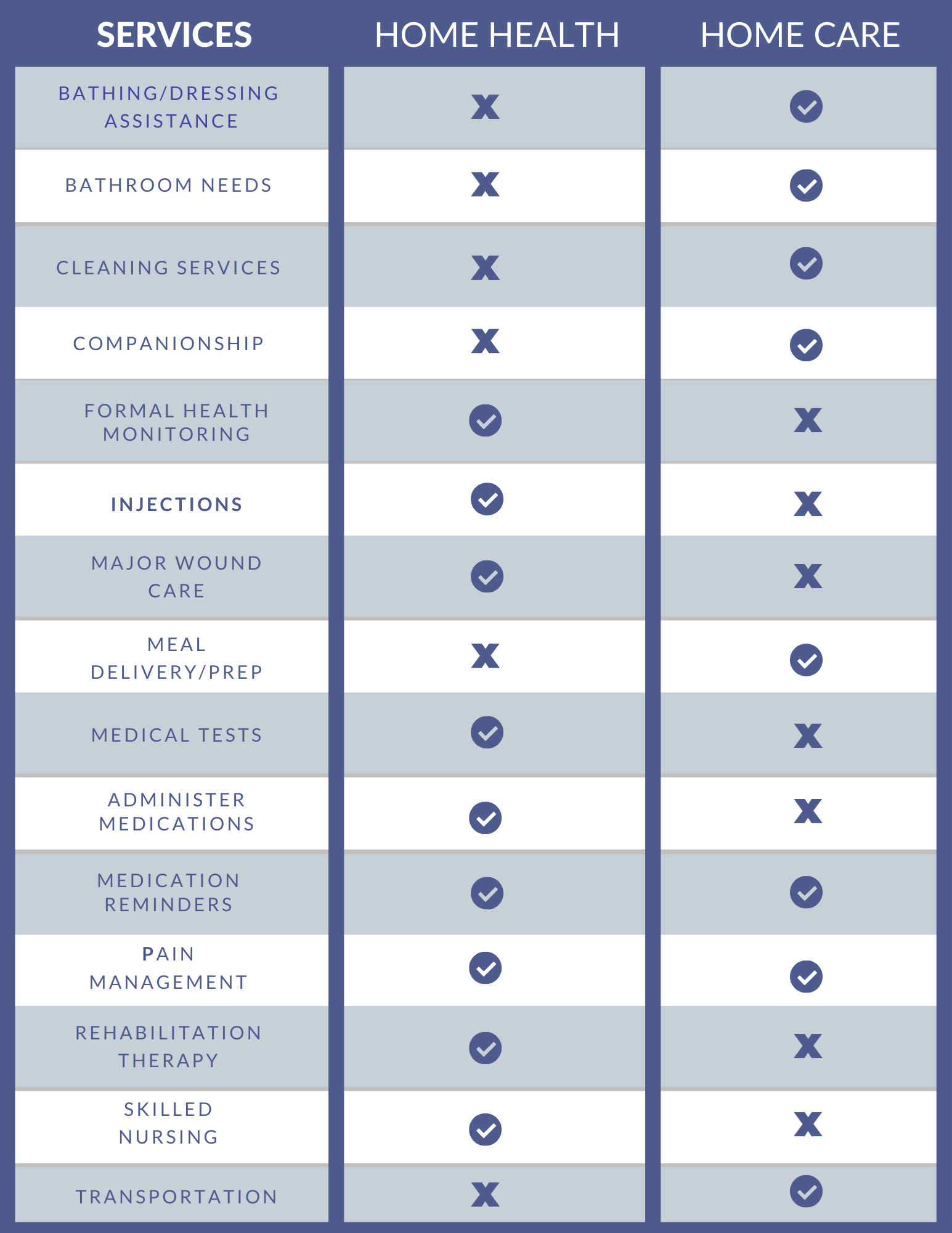

Ask questions so you understand why your doctor is recommending certain services and if, or how much, Medicare will pay for them. Not all home care services offer the same peace of mind, and there are some important, but often unrecognized, issues to consider when hiring a caregiver. Home care services are best when provided through an agency that employs, trains, bonds and insures, and background checks its caregivers. This allows to you have peace of mind knowing that you are bringing someone into your home that you can trust. In addition, the agency will take care of any legal issues that occur should the caregiver or client be injured on the job.

This means they must communicate regularly with you, your doctor, and anyone else who gives you care. With Amwins by your side, you not only get industry-specific expertise and data-driven insights - you get a direct extension of your team.

Who Provides Home Care

You must be under the care of a doctor, and you must be getting services under a plan of care created and reviewed regularly by a doctor. The UNL Home Health Care Shield, Short-Term Home Health Care Insurance, pays cash benefits directly to you. Enjoy the option to recuperate in the comfort of your own home with help from falling behind financially. We'll show you how to implement Client Training Services and Risk Management Reporting that get results. GTL will pay a benefit amount of $10 for each generic or $25 for each brand name prescription drug up to a policy year maximum of $300 for Plan A, $600 for Plan B or $600 for Plan C. You can choose a daily benefit amount of $40/day for Plan A, $80/day for Plan B or $120/day for Plan C.

So, it is vital to check a private caregiver's criminal and sexual abuse records at least annually. By comparison, there are just over 1.8 million individuals in nursing homes. Once your doctor refers you for home health services, the home health agency will schedule an appointment and come to your home to talk to you about your needs and ask you some questions about your health.

Comparing Long-Term Care Insurance Providers

The company's hybrid life insurance and long-term care insurance plan offers customers LTC coverage if needed or dependents can receive a payout. A unique feature of this plan is the option to link it to the market indices—giving customers the chance to grow LTC benefits, with built-in protection during economic downturns and the option to lock in the value at any time. New York Life offers a combination policy that provides long-term care benefits if you need them and a death benefit if you don't. In the event that no long-term care is needed, there's also a money-back guarantee.

Lincoln Financial Group offers four plans with no waiting periods and it also provides benefits to those living abroad. Seniors who have private health insurance may find those plans will cover home health care in a limited capacity. Most private plans cover a portion of the cost of skilled in-home care but do not cover non-medical home care at all. For this reason, it’s important to read policy documents carefully and plan ahead when it comes to paying for long-term care for seniors. Her plan allows her $300 per day in benefits for skilled nursing care and lowers the costs of her medications. Your doctor or other health care provider may recommend you get services more often than Medicare covers.

To qualify for benefits, a Licensed Health Care Practitioner must certify you as having a Cognitive Impairment or the inability to perform at least two of six Activities of Daily Living without substantial assistance . To select the best long-term care insurance, we considered each company's history and financial strength ratings, the types of coverage offered, specific policies, pricing, and what types of discounts are available. Founded in 1845, New York Life is one of the top-rated long-term care insurance providers in terms of overall financial strength. It has received the highest ratings for financial strength by the top rating services, including an A++ from AM Best. Suburban’s Concierge Care lets us offer home health care services that extend beyond services covered by traditional medical insurance, like Medicare, Medicaid, and commercial insurance plans.

Fernando Flores is an anti-money laundering specialist for Transnetwork and an international remittances payment aggregator. While completing his master's, he studied and Latin America, Asia Pacific, and North American economic development trends. He has published articles as a guest writer for the most influential English-language media outlet in Japan, The Japan Times. Our Home Health Care package insurance is designed to fulfill a wide range of special insurance needs for the Home Health Care sector. Each policy is custom tailored to address each insured's unique exposures. Use or replication of this content by other web sites or commercial entities without written permission is strictly prohibited.

A critical illness such as cancer, a stroke or heart attack impacts millions of Americans yearly. To learn more about critical illness insurance please visit the website of our sister association the Click here for the American Association for Critical Illness Insurance. The home health agency staff will also talk to your doctor about your care and keep your doctor updated about your progress. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

The company's terminal illness rider allows for a one-time claim of 25% to 75% of the death benefit up to $250,000 in the event of a terminally life-threatening condition. With MoneyGuard II, a universal life insurance plan with an optional long-term care benefit rider, premiums are locked in from the start. Customers can get tax-free reimbursements for qualifying LTC costs, and there's no waiting period. Medicare will cover home health care for homebound seniors if they have been prescribed that care by a medical professional.

Home health care is often included in Medicaid Home and Community Based Services waivers. These are managed on a state level, so seniors should check with their state’s providers to confirm what services are included in any available waivers. Home health care can be a valuable service for seniors who require limited medical care such as medication reminders, wound care, injections or IV therapy. The goal of home health care is to maintain a senior’s health and well-being and help them regain their independence, delaying the transition into an assisted living facility. NoteIf you get services from a home health agency in Florida, Illinois, Massachusetts, Michigan, or Texas, you may be affected by a Medicare demonstration program.

They may also include personal care services, or those that help with the activities of daily living, including home care services like bathing, dressing, and grooming. To promote a safe and functional lifestyle, a caregiver can help you brush your teeth, secure the buttons on your shirt, or stand-by while you bathe to make sure you do not fall. Brighthouse Financial also offers a guaranteed death benefit and terminal illness benefit, with a payout of 50% of the policy's value capped at $250,000. No labs or exams are required for customers ages 40 to 75, and no medical records are required for those 40 to 65, except in the event of a significant medical condition. GTL's Short-Term Home Health Care Insurance will pay a daily benefit for each day you receive a variety home health care services.

No comments:

Post a Comment